Page 66 - RFU Annual Report 2017

P. 66

64

Financial Statements

Notes to the Financial Statements continued

13. Tangible fixed assets continued

Assets in the course of construction as at 30 June 2017 represent costs in respect of the on-going stadium works and AGPs.

Land and buildings of the Group and Parent includes freehold land and works of art of £4.5m (2016: £4.5m).

The amount of interest capitalised during the year was £0.1m (2016: £nil). The total amount of interest capitalised to date is

£12.6m (2016: £12.5m). Interest was capitalised at a rate of 2.3% (2016: 2.3%).

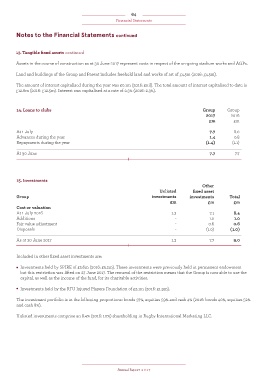

14. Loans to clubs Group Group

2017 2016

£m £m

At 1 July 7.7 8.0

Advances during the year 1.4 0.8

Repayments during the year (1.4) (1.1)

At 30 June 7.7 7.7

1)

2)

3)

15. Investments 4)

5)

Other 6)

Unlisted fixed asset 7)

Group investments investments Total 8)

£m £m £m 9)

Cost or valuation 10)

At 1 July 2016 1.3 7.1 8.4 11)

Additions - 1.0 1.0 12)

Fair value adjustment - 0.6 0.6 13)

Disposals - (1.0) (1.0) 14)

15)

As at 30 June 2017 1.3 7.7 9.0 16)

17)

Included in other fixed asset investments are:

Investments held by SPIRE of £5.6m (2016: £5.2m). These investments were previously held in permanent endowment

but this restriction was lifted on 27 June 2017. The removal of the restriction means that the Group is now able to use the

capital, as well as the income of the fund, for its charitable activities.

Investments held by the RFU Injured Players Foundation of £2.1m (2016: £1.9m).

The investment portfolio is in the following proportions: bonds 37%, equities 59% and cash 4% (2016: bonds 40%, equities 52%

and cash 8%).

Unlisted investments comprise an 8.4% (2016: 10%) shareholding in Rugby International Marketing LLC.

Annual Report 2017