Page 70 - RFU Annual Report 2017

P. 70

68

Financial Statements

Notes to the Financial Statements continued

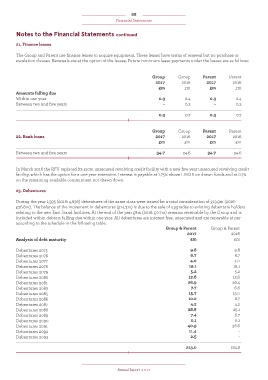

21. Finance leases

The Group and Parent use finance leases to acquire equipment. These leases have terms of renewal but no purchase or

escalation clauses. Renewals are at the option of the lessee. Future minimum lease payments under the leases are as follows:

Group Group Parent Parent

2017 2016 2017 2016

£m £m £m £m

Amounts falling due

Within one year 0.3 0.4 0.3 0.4

Between two and five years - 0.3 - 0.3

0.3 0.7 0.3 0.7

Group Group Parent Parent

22. Bank loans 2017 2016 2017 2016

£m £m £m £m

Between two and five years 34.7 24.6 34.7 24.6

In March 2016 the RFU replaced its £10m unsecured revolving credit facility with a new five year unsecured revolving credit

facility, which has the option for a one year extension. Interest is payable at 1.75% above LIBOR on drawn funds and at 0.7%

on the remaining available commitment not drawn down.

23. Debentures

During the year 1,335 (2016: 4,636) debentures of the same class were issued for a total consideration of £13.9m (2016:

£36.6m). The balance of the movement in debentures (£14.3m) is due to the sale of upgrades to existing debenture holders

relating to the new East Stand facilities. At the end of the year £8m (2016: £0.7m) remains receivable by the Group and is

included within debtors falling due within one year. All debentures are interest free, unsecured and are repayable at par

according to the schedule in the following table.

Group & Parent Group & Parent

2017 2016

Analysis of debt maturity £m £m

Debentures 2075 9.8 9.8

Debentures 2076 6.7 6.7

Debentures 2077 4.0 4.0

Debentures 2078 19.1 19.1

Debentures 2079 5.2 5.2

Debentures 2080 12.6 12.6

Debentures 2081 26.9 26.4

Debentures 2083 7.7 6.6

Debentures 2085 15.7 13.0

Debentures 2086 10.2 8.7

Debentures 2087 4.2 4.2

Debentures 2088 28.6 25.1

Debentures 2089 7.4 6.7

Debentures 2090 0.1 0.1

Debentures 2091 40.9 36.6

Debentures 2092 11.4 -

Debentures 2093 2.5 -

213.0 184.8

Annual Report 2017