Page 69 - RFU Annual Report 2017

P. 69

67

Financial Statements

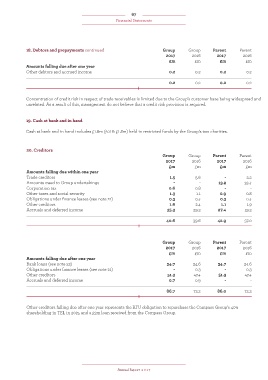

18. Debtors and prepayments continued Group Group Parent Parent

2017 2016 2017 2016

£m £m £m £m

Amounts falling due after one year

Other debtors and accrued income 0.2 0.2 0.2 0.2

0.2 0.2 0.2 0.2

Concentration of credit risk in respect of trade receivables is limited due to the Group’s customer base being widespread and

unrelated. As a result of this, management do not believe that a credit risk provision is required.

19. Cash at bank and in hand

Cash at bank and in hand includes £1.8m (2016: £1.8m) held in restricted funds by the Group’s two charities.

20. Creditors

Group Group Parent Parent

2017 2016 2017 2016

£m £m £m £m

Amounts falling due within one year

Trade creditors 1.5 5.6 - 2.2

Amounts owed to Group undertakings - - 13.2 32.4

Corporation tax 0.6 0.8 - -

Other taxes and social security 1.3 1.1 0.9 0.8

Obligations under finance leases (see note 21) 0.3 0.4 0.3 0.4

Other creditors 1.6 2.4 1.1 1.9

Accruals and deferred income 35.3 29.3 27.4 19.3

40.6 39.6 42.9 57.0

Group Group Parent Parent

2017 2016 2017 2016

£m £m £m £m

Amounts falling due after one year

Bank loans (see note 22) 34.7 24.6 34.7 24.6

Obligations under finance leases (see note 21) - 0.3 - 0.3

Other creditors 51.3 47.4 51.3 47.4

Accruals and deferred income 0.7 0.9 - -

86.7 73.2 86.0 72.3

Other creditors falling due after one year represents the RFU obligation to repurchase the Compass Group’s 40%

shareholding in TEL in 2025 and a £3m loan received from the Compass Group.

Annual Report 2017