Page 63 - RFU Annual Report 2017

P. 63

61

Financial Statements

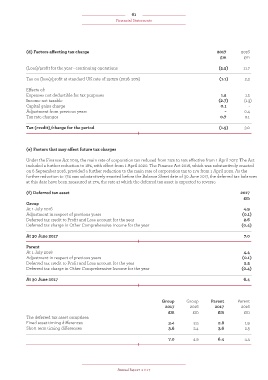

(d) Factors affecting tax charge 2017 2016

£m £m

(Loss)/profit for the year - continuing operations (5.5) 11.7

Tax on (loss)/profit at standard UK rate of 19.75% (2016: 20%) (1.1) 2.3

Effects of:

Expenses not deductible for tax purposes 1.5 1.5

Income not taxable (2.7) (1.3)

Capital gains charge 0.1 -

Adjustment from previous years - 0.4

Tax rate changes 0.7 0.1

Tax (credit)/charge for the period (1.5) 3.0

(e) Factors that may affect future tax charges

Under the Finance Act 2015, the main rate of corporation tax reduced from 20% to 19% effective from 1 April 2017. The Act

included a further reduction to 18%, with effect from 1 April 2020. The Finance Act 2016, which was substantively enacted

on 6 September 2016, provided a further reduction to the main rate of corporation tax to 17% from 1 April 2020. As the

further reduction to 17% was substantively enacted before the Balance Sheet date of 30 June 2017, the deferred tax balances

at this date have been measured at 17%, the rate at which the deferred tax asset is expected to reverse.

(f) Deferred tax asset 2017

£m

Group

At 1 July 2016 4.9

Adjustment in respect of previous years (0.1)

Deferred tax credit to Profit and Loss account for the year 2.6

Deferred tax charge in Other Comprehensive Income for the year (0.4)

At 30 June 2017 7.0

Parent

At 1 July 2016 4.4

Adjustment in respect of previous years (0.1)

Deferred tax credit to Profit and Loss account for the year 2.5

Deferred tax charge in Other Comprehensive Income for the year (0.4)

At 30 June 2017 6.4

Group Group Parent Parent

2017 2016 2017 2016

£m £m £m £m

The deferred tax asset comprises:

Fixed asset timing differences 3.4 2.5 2.8 1.9

Short term timing differences 3.6 2.4 3.6 2.5

7.0 4.9 6.4 4.4

Annual Report 2017