Page 67 - RFU Annual Report 2015/2016

P. 67

Financial Statements

65

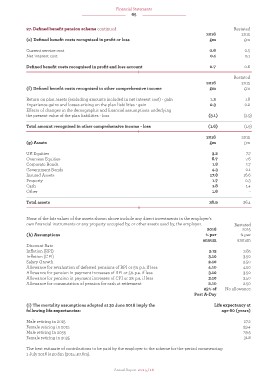

27. Defined benefit pension scheme continued Restated

2016 2015

(e) Defined benefit costs recognised in profit or loss £m £m

Current service cost 0.6 0.5

Net interest cost 0.1 0.1

Defined benefit costs recognised in profit and loss account 0.7 0.6

Restated

2016 2015

(f) Defined benefit costs recognised in other comprehensive income £m £m

Return on plan assets (excluding amounts included in net interest cost) - gain 1.2 1.8

Experience gains and losses arising on the plan liabilities - gain 0.3 0.2

Effects of changes in the demographic and financial assumptions underlying

the present value of the plan liabilities - loss (3.1) (3.9)

Total amount recognised in other comprehensive income - loss (1.6) (1.9)

2016 2015

(g) Assets £m £m

UK Equities 3.2 7.7

Overseas Equities 6.7 7.6

Corporate Bonds 1.8 2.7

Government Bonds 4.3 0.1

Insured Assets 17.8 16.6

Property 1.7 0.3

Cash 1.8 1.4

Other 1.6 -

Total assets 38.9 36.4

None of the fair values of the assets shown above include any direct investments in the employer’s

own financial instruments or any property occupied by, or other assets used by, the employer. Restated

2016 2015

(h) Assumptions % per % per

annum annum

Discount Rate

Inflation (RPI) 3.15 3.85

Inflation (CPI) 3.10 3.50

Salary Growth 2.10 2.50

Allowance for revaluation of deferred pensions of RPI or 5% p.a. if less 4.10 4.50

Allowance for pension in payment increases of RPI or 5% p.a. if less 3.10 3.50

Allowance for pension in payment increases of CPI or 3% p.a. if less 3.10 3.50

Allowance for commutation of pension for cash at retirement 2.10 2.50

25% of No allowance

Post A-Day

(i) The mortality assumptions adopted at 30 June 2016 imply the Life expectancy at

following life expectancies: age 60 (years)

Male retiring in 2015 27.2

Female retiring in 2015 29.4

Male retiring in 2035 29.5

Female retiring in 2035 31.8

The best estimate of contributions to be paid by the employer to the scheme for the period commencing

1 July 2016 is £0.6m (2015: £0.6m).

Annual Report 2015/16