Page 70 - RFU Annual Report 2015/2016

P. 70

Financial Statements

68

Notes to the Financial Statements continued

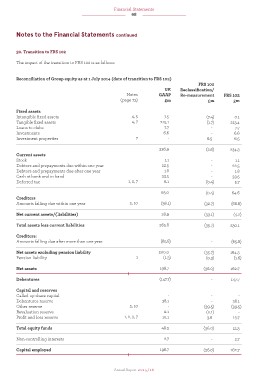

30. Transition to FRS 102

The impact of the transition to FRS 102 is as follows:

Reconciliation of Group equity as at 1 July 2014 (date of transition to FRS 102)

FRS 102

UK Reclassification/

Notes GAAP Re-measurement FRS 102

(page 73) £m £m £m

Fixed assets

Intangible fixed assets 4, 5 7.5 (7.4) 0.1

Tangible fixed assets 4, 7 215.1 (1.7) 213.4

Loans to clubs 7.7 - 7.7

Investments 6.6 - 6.6

Investment properties 7 - 6.5 6.5

236.9 (2.6) 234.3

Current assets

Stock 1.1 - 1.1

Debtors and prepayments due within one year 22.5 - 22.5

Debtors and prepayments due after one year 1.8 - 1.8

Cash at bank and in hand 33.5 - 33.5

Deferred tax 1, 2, 7 6.1 (0.4) 5.7

65.0 (0.4) 64.6

Creditors

Amounts falling due within one year 2, 10 (36.1) (32.7) (68.8)

Net current assets/(liabilities) 28.9 (33.1) (4.2)

Total assets less current liabilities 265.8 (35.7) 230.1

Creditors:

Amounts falling due after more than one year (65.8) - (65.8)

Net assets excluding pension liability 200.0 (35.7) 164.3

Pension liability 1 (1.3) (0.3) (1.6)

Net assets 198.7 (36.0) 162.7

Debentures (147.7) - 147.7

Capital and reserves

Called up share capital - - -

Debentures reserve 38.1 - 38.1

Other reserve 5, 10 - (39.5) (39.5)

Revaluation reserve 0.1 (0.1) -

Profit and loss reserve 1, 2, 3, 7 10.1 3.6 13.7

Total equity funds 48.3 (36.0) 12.3

Non-controlling interests 2.7 - 2.7

Capital employed 198.7 (36.0) 162.7

Annual Report 2015/16