Page 66 - RFU Annual Report 2015/2016

P. 66

Financial Statements

64

Notes to the Financial Statements continued

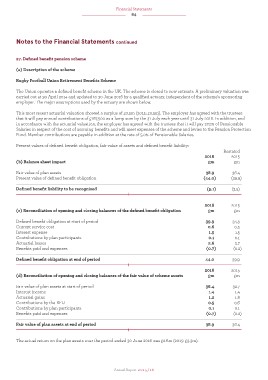

27. Defined benefit pension scheme

(a) Description of the scheme

Rugby Football Union Retirement Benefits Scheme

The Union operates a defined benefit scheme in the UK. The scheme is closed to new entrants. A preliminary valuation was

carried out at 30 April 2014 and updated to 30 June 2016 by a qualified actuary, independent of the scheme’s sponsoring

employer. The major assumptions used by the actuary are shown below.

This most recent actuarial valuation showed a surplus of £0.5m (2015: £0.5m). The employer has agreed with the trustees

that it will pay annual contributions of £167,500 as a lump sum by the 31 July each year until 31 July 2018. In addition, and

in accordance with the actuarial valuation, the employer has agreed with the trustees that it will pay 27.5% of Pensionable

Salaries in respect of the cost of accruing benefits and will meet expenses of the scheme and levies to the Pension Protection

Fund. Member contributions are payable in addition at the rate of 5.0% of Pensionable Salaries.

Present values of defined benefit obligation, fair value of assets and defined benefit liability:

Restated

2016 2015

(b) Balance sheet impact £m £m

Fair value of plan assets 38.9 36.4

Present value of defined benefit obligation (44.0) (39.9)

Defined benefit liability to be recognised (5.1) (3.5)

2016 2015

(c) Reconciliation of opening and closing balances of the defined benefit obligation £m £m

Defined benefit obligation at start of period 39.9 34.3

Current service cost 0.6 0.5

Interest expense 1.5 1.5

Contributions by plan participants 0.1 0.1

Actuarial losses 2.6 3.7

Benefits paid and expenses (0.7) (0.2)

Defined benefit obligation at end of period 44.0 39.9

2016 2015

(d) Reconciliation of opening and closing balances of the fair value of scheme assets £m £m

Fair value of plan assets at start of period 36.4 32.7

Interest income 1.4 1.4

Actuarial gains 1.2 1.8

Contributions by the RFU 0.5 0.6

Contributions by plan participants 0.1 0.1

Benefits paid and expenses (0.7) (0.2)

Fair value of plan assets at end of period 38.9 36.4

The actual return on the plan assets over the period ended 30 June 2016 was £2.6m (2015: £3.3m).

Annual Report 2015/16